Does producing higher-quality food lead to a price premium in the market? We analysed the impact that a Protected Geographical (PGI) label had on the price and sales of Orkney cheddar, which gained its PGI status in 2013. A PGI label identifies a product as originating in a specific place, region or country, and has a known quality, reputation of other characteristic attributable to that specific location. Using data from 2006–2023, we examined sales and pricing to measure policy impact. While Orkney cheddar is priced above other cheddars, it’s unclear if the PGI itself has boosted profits.

Stage

Directory of Expertise

Purpose

This research is determining whether the production of higher-quality food products is recognised by the market in offering a premium (a higher sale price) with respect to similar products. It is possible that attaining higher quality has higher costs of production and marketing and overall may mean that it is not beneficial for producers to reach that higher level of quality. Therefore, it is important to quantify the trade-offs between price premiums and production costs.

This study focuses on Orkney cheese, a cheddar cheese with a Protected Geographical Indication (PGI) label.

This case study analyses the impact that gaining a PGI label in December 2013 had on the marketing of Orkney cheddar (sales and price).

The history of Orkney cheddar

Orkney cheddar was granted PGI status by the European Union in December 2013 under the name of Orkney Scottish Island Cheddar. It is produced with locally sourced milk from the Orkney Isles using a traditional recipe and process created in 1946.

The originally creamery was built after World War II on the site of a former RAF base just outside Kirkwall. During one of our interviews, the manager told us that the creamery has only moved twice since when it started. At the end of the war, the departure of 60,000 personnel left a surplus of milk amongst the local dairy farmers. They decided to join forces and started the production of Orkney Scottish Island Cheddar. The cheese is typically matured for 10 to 18 months giving a variety of medium, mature and extra mature flavour profiles.

According to Tim Deakin, manager of the Orkney cheese company, in an interview to the BBC in 2010 “the company can only produce as much cheese as the cows on Orkney can produce milk, so expanding to improve economies of scale is not an option. Its remote island location means high shipping costs, so to make money Orkney Cheese has to justify a premium price tag. Due to the recession, they have felt the change in the demand reflected from the changes in the buying habits of consumers in the rest of the UK.” He added that "We've had to go into more promotional lines simply to sell the volume that we produce," he said. "That has reduced our average selling price, so consequently we have reduced the milk price back to the farmers" (BBC, 2010).

As regards the supply chain: The Orkney Cheese Company, The Caledonian Cheese Company Limited, The Fresh Milk Company Limited and McLelland Cheese Packing Limited are all part of the Lactalis-McLelland Limited group, which is owned by the French dairy company Lactalis.

Results

Data

We used the Kantar Worldpanel dataset for Scotland (part of the GB Worldpanel), a survey that contains weekly food and drink purchases for consumption at home for about 3,000 households.

We constructed time series of 13 4-week months for the period 2006 to 2023 (i.e. 234 observations) of different cheddar cheeses in the Scottish market. Two series were constructed: (1) Orkney cheddar and (2) Other cheddars (i.e. cheddar cheeses without PGI). These were used to construct a panel (i.e. two different individuals, i.e. Orkney and non-Orkney, observed for 234 periods).

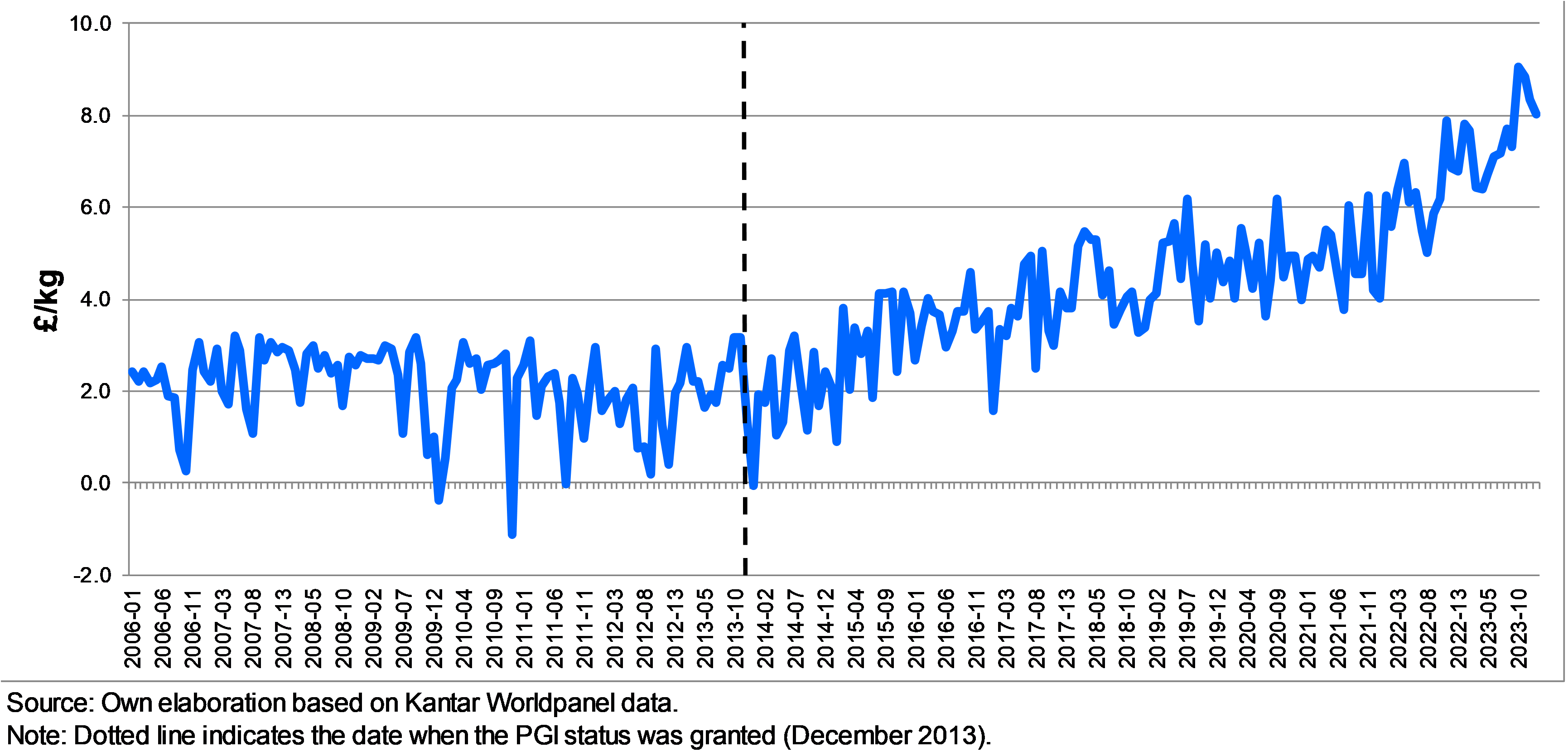

Figure 1 shows the evolution of Orkney cheddar prices for the period 2006 to 23. They present an upward trend after the introduction of the PGI in December 2013.

Figure 1 – Scotland - Orkney cheese price, 2006-23

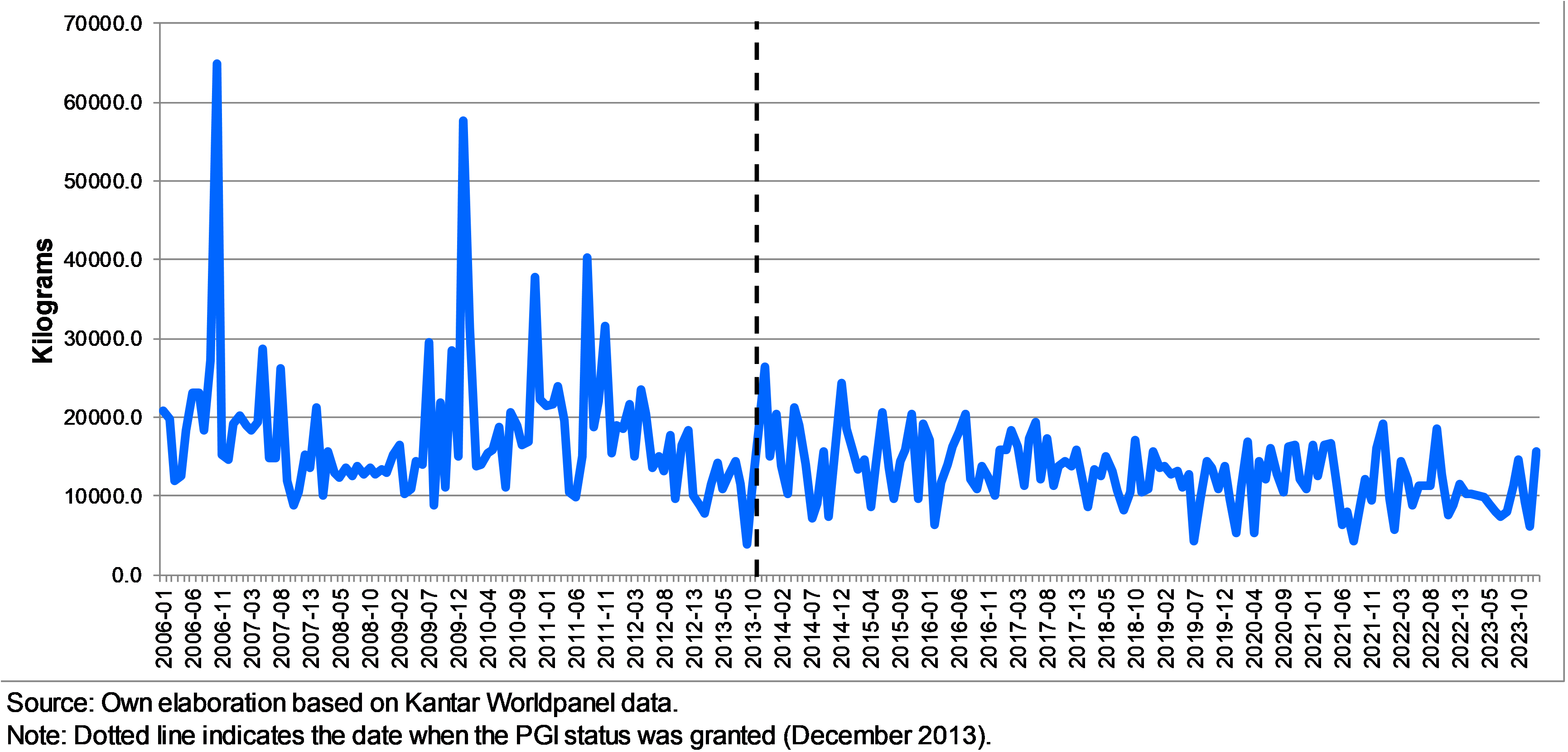

In contrast to Figure 1 (above), Figure 2 (below) shows that the quantities produced seemed to be more stable after the introduction of the PGI. Thus, the coefficient of variation i.e. the standard deviation divided by mean, which is an indicator of variability, goes from 0.36 to 0.27 when comparing the period before and after the introduction of the PGI. This means the price has less variability after the PGI introduction.

Figure 2 - Scotland - Orkney Scottish Island Cheddar cheese sold quantities, 2006-23

Figure 3 (below) presents the difference in the prices between the Orkney Scottish Island Cheddar and non-Orkney cheddars (i.e., Scottish, British or all origin cheddars). The series clearly has an upward trend after the introduction of the PGI label, indicating an increasing price premium for Orkney Scottish Island Cheddar.

Figure 3 - Difference Orkney cheese and non-Orkney Cheddars prices, 2006-23

Figure 4 (below), which shows Orkney cheese market share, shows a behaviour similar to the situation of quantities seen in figures 1 and 2. The market share of Orkney Scottish Island Cheddar seems more stable after the introduction of the PGI status. This is reflected on the fact that the coefficient of variation goes from 0.38 to 0.28.

Figure 4 – Orkney cheese market share with respect to all Cheddars in Scotland, 2006-23

Statistical analysis

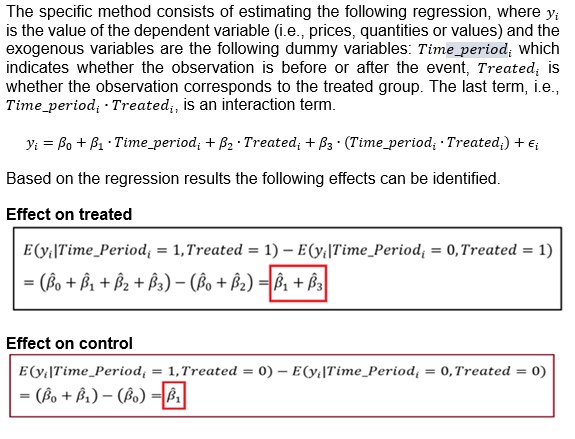

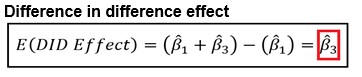

To test statistically whether the introduction of the PGI had some impact on producers the study used the Difference-in-Differences (DiD) regression model.

The DiD is a method to measure policy impact and is used to estimate the differential impact of a ‘treatment’ on the treated group of individuals. In this case, the “treated individuals or group” are the producers of Orkney Scottish Island Cheddar, and the “treatment” is the introduction of the PGI status. The control group (needed for comparison with the treated group) is all the producers of cheddar sold in Scotland without PGI.

Figure 5 – Example of the Difference in Difference approach

Results of Analysis - Impact of PGI status on Orkney Cheddar

The DiD analysis showed that when Orkney Scottish Island Cheddar was awarded its PGI label, the price consumers paid for it went up compared to other cheeses. Therefore, the PGI helped Orkney Cheddar command a higher price on the market.

However, this doesn’t necessarily mean that producers made more profit. Without knowing the costs involved, for example, higher transport costs, we can’t say for sure whether the extra income covered these expenses.

Looking at overall sales (price multiplied by quantity sold), the results suggest that even though prices rose, total revenues actually went down because fewer purchases were made.

Benefits

The picture coming from the analysis is not definitive. The introduction of the PGI shows two positive effects: first, the price for Orkney Scottish Island Cheddar increased after the introduction of the PGI, i.e. there is a premium with respect to other cheddar cheeses. However, given the trend it is not clear whether this is due to increasing marketing costs (e.g. shipping costs).

Second, the sales of Orkney Scottish Island Cheddar show lower variability. This is positive for producers in the sense that it is much easier for them to predict their sales. However, when comparing the periods pre and post introduction of the PGI, there is a decrease in sales (i.e., in revenues) which means that the fall in the amount of the quantities sold was more significant than the increase in prices.

Overall, the results may suggest that for quality labels to be effective mechanisms to improve the producers’ situation (i.e., increase profit), they require to be backed by consumers understanding of the label’s information, so they see them as a sign of true differentiation with respect to other products.

This research helps us understand whether food quality labels, like the PGI for Orkney Cheddar, really make a difference for producers and consumers. The benefits include:

• Showing if PGI status helps products achieve higher prices in the market.

• Identifying whether higher prices translate into more stable sales or better profits.

• Highlighting challenges producers face, such as rising costs.

• Helping policymakers and industry decide how best to support premium Scottish products.

• Providing insights that can be applied to other quality-labelled foods in Scotland and beyond.

References

Revoredo-Giha, C. and Akaichi, F (2016). A Review of Protected Food Names (PFNs). AA211 Special Study Report to RESAS.