As improving nutritional quality and sustainability can raise production costs, understanding willingness to pay is crucial. This study shows that taste and price are the strongest drivers of UK cheese purchases. Consumers are willing to pay a premium for Scottish cheddar, though a “British” label generates higher perceived value. Sustainability claims, especially “Carbon Neutral”, and nutrition messaging such as “High in Protein”, further increase willingness to pay and strengthen product appeal. These findings suggest that using targeted ecolabels and health claims could help Scottish cheddar achieve stronger market positioning, justify higher prices, and better align with evolving consumer expectations.

Stage

Directory of Expertise

Purpose

This study aims to provide evidence to inform strategies (e.g., Dairy Action Plan) for enhancing the market value of Scottish cheddar cheese. The key objectives are to:

1. Assess UK consumers’ preferences and willingness to pay for cheddar cheese.

2. Evaluate the impact of eco-labels and nutrition claims on consumer perceptions and product appeal.

3. Examine the variation in consumer preferences and identify distinct market segments based on differing preferences.

Results

Methods

This study investigated the factors that influence consumer decisions when purchasing cheddar cheese. To achieve this, the authors conducted a survey involving 1,200 consumers of cheddar cheese. The sample is representative of the UK population in terms of age, gender, employment status, and UK nations.

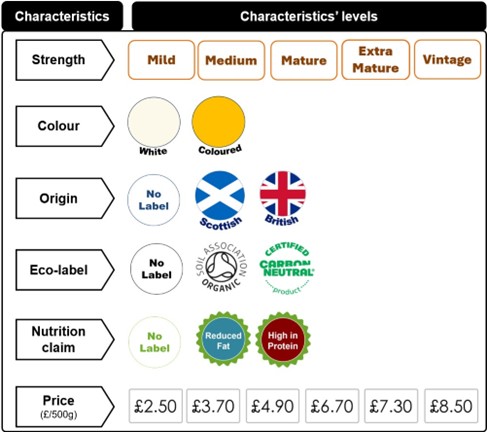

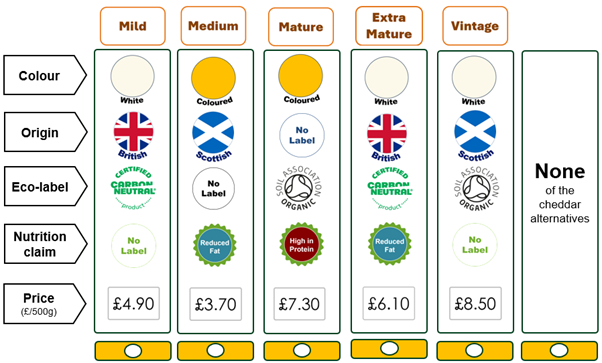

Participants were asked to make choices between different types of cheddar cheese, each with varying characteristics. The attributes (Figure 1) considered were cheese strength, colour, origin labelling, ecolabels, nutrition claims, and price for a standard 500g block. Each person completed twelve choice questions, selecting from five different cheddar cheese options in each choice question (Figure 2).

Figure 1. Cheddar cheese’s attributes and attribute levels considered in the study

Figure 2. Example of one of the twelve choice questions considered in the study

The data were analysed using a latent class model, which identifies groups of consumers with similar preferences. The analysis revealed three distinct consumer groups/segments, each showing different preferences and willingness to pay for specific cheese attributes.

Results

1. Segments’ profile: The latent class analysis identified three distinct consumer segments. Segment 1 (42% of respondents) includes the highest proportion of Scottish participants and is predominantly composed of retired individuals with medium levels of education. Segment 2 (35%) consists mainly of younger, highly educated consumers. In contrast, Segment 3 is characterised by a higher representation of female, self-employed, and middle-aged respondents.

2. Cheese maturity: Strength was the most valued attribute across all segments, but preferences varied. Segment 1 (42%) preferred medium cheddar, Segment 2 (23%) favoured extra mature, and Segment 3 (35%) chose mature cheddar, with this group also paying the highest premium.

3. Origin: The majority of consumers (Segments 2 and 3, 58%) preferred British-labelled cheddar, with a willingness-to-pay premium 59% higher than for Scottish cheddar. In contrast, Segment 1 favoured Scottish-labelled cheddar, though this preference was weak, reflected in only a marginal £0.03 premium over British cheddar.

4. Ecolabels: Segment 2 valued sustainability highly, paying substantial premiums for both the “Carbon Neutral” (£2.06) and “Organic” (£1.67) labels. Segment 1 valued only the “Carbon Neutral” label, and at a much smaller premium (£0.20), while Segment 3 was found to be unwilling to pay a premium for the use of ecolabels.

5. Nutrition claims: The majority of consumers (Segments 1 and 3, 65%) showed no willingness to pay for “High in Protein” or “Reduced Fat” claims. By contrast, Segment 2 demonstrated strong support for “High in Protein,” with a sizeable premium (£2.38), though they were indifferent toward “Reduced Fat.”

6. Colour: Only Segment 3 showed a preference for coloured cheddar, reflected in a modest £0.84 premium over white cheddar. The majority of consumers (Segments 1 and 2) were indifferent between coloured and white varieties, indicating that colour played little role in their decision-making.

Benefits

The findings offer several policy and market implications for supporting the production of higher-value cheddar. First, consumer preferences vary widely, but most favour medium, mature, or extra mature cheddar. Ensuring strong availability of these types would best meet demand.

Second, origin labelling strongly influences willingness to pay. While most consumers prefer British-labelled cheddar and would pay significantly more for it, a sizable minority favour Scottish-labelled products. A dual strategy is recommended: market cheddar as Scottish within Scotland and British in broader UK markets to maximise appeal.

Third, nutrition claims matter to only a minority, but those interested place a high value on the label “High in Protein.” Clear labelling targeted at health-focused consumers could support product differentiation without overwhelming general shoppers.

Fourth, sustainable production messages attract economically significant premiums, especially “Carbon Neutral,” which consumers value more than “Organic.” Prioritising carbon-focused ecolabels could better align with market expectations and support environmental goals.

Fifth, cheese colour is a low-priority factor. Most consumers are indifferent between white and coloured cheddar, though a small group prefers coloured options and will pay modestly more. Maintaining both choices while pricing coloured cheddar carefully will prevent discouraging the majority.

Finally, price remains the most important factor in purchasing decisions. While value-added labels and claims can justify moderate price increases, maintaining affordability is essential. Policy and industry strategies should therefore strike a balance between premiumisation and fair pricing to ensure accessibility and maintain consumer trust.

Overall, tailoring labelling, pricing, and product positioning to distinct consumer segments can strengthen market competitiveness and support sustainable development in the dairy sector.

Project Partners

SRUC

The Rowett Institute