It has been reported that the UK exiting of the European Union (Brexit) has affected salmon industry. Both the volume and value of salmon exported to the EU, which still is the main market for Scottish Salmon, have been impacted.

In response, this case study aims to analyse whether Brexit has had any effect on the premium paid for Scottish salmon (under the French quality indicator Label Rouge or not) with respect to other origins (i.e., Norwegian) in a French wholesale market. The result of the statistical analysis indicated that Brexit did not have any effect on the premiums. However, this does not mean that Brexit will not have affected the exports of Scottish salmon.

This is one of three linked case studies on different aspects of the high value salmon sector.

Stage

Work in ProgressDirectory of Expertise

Purpose

In April 2024,The Grocer reported (based on Salmon Scotland data) that Brexit had cost Scottish salmon producers up to £100m in administrative burden due to increased paperwork.

Since Brexit both the volume and value of salmon exports have decreased. In terms of volumes, around 44 thousand tonnes of Scottish salmon were exported to the EU in 2023, which meant a decrease of 17% with respect to 2019. While in terms of values, the decrease was only down by 3% to £356m last year due to strong global demand and inflation driving up prices. However, the EU is still the most significant region for Scottish exports as it accounts for more than 60% of international sales.

Therefore, the purpose of this case study was to analyse whether the relationships between the price of salmon from different origins has changed since the UK exited the European Union (Brexit).

In particular, our focus is whether Brexit affected the relationship of Scottish salmon prices with respect to other origins (i.e., Norway) in the EU market. This is interesting, and of importance, because changes in the premium may indicate a change in customers’ (and ultimately, consumers) preferences.

Results

The data used for the analysis were the wholesale daily price of entire fresh farmed salmon (€/kg excluding taxes) from the Rungis International Market (RIM) (French: Marché International de Rungis) since 2001. RIM is the principal wholesale market of Paris and deals in food and horticultural products. It is also the main market for Scottish salmon.

The Scottish data were for the entire salmon weighting 2-3 kg. The Norwegian data available were for 2-3 kg, 3-4 kg, 4-5 kg, 5-6 kg and 6-7 kg. Two prices were considered for the Scottish origin: for Scottish salmon (without label) and for the Scottish salmon sold under the French quality label ‘Label Rouge’.

The Label Rouge is a French label, which refers to products which by their terms of production or manufacture have a higher level of quality compared to other similar products usually marketed. Scottish salmon was the first fish and first non-French product to be awards the quality mark in 1992, which recognises the superior quality of a food or farmed product, particularly with regard to taste. Quality in the case of Label Rouge refers to all the properties and characteristics of a product. A Label Rouge product may benefit simultaneously from a Protected Geographical Indication or a Traditional Speciality Guaranteed, but not an original (Controlled Designation of Origin / Protected designation of origin). In 2022, Scottish salmon celebrated 30 years of holding the Label Rouge quality mark in France.

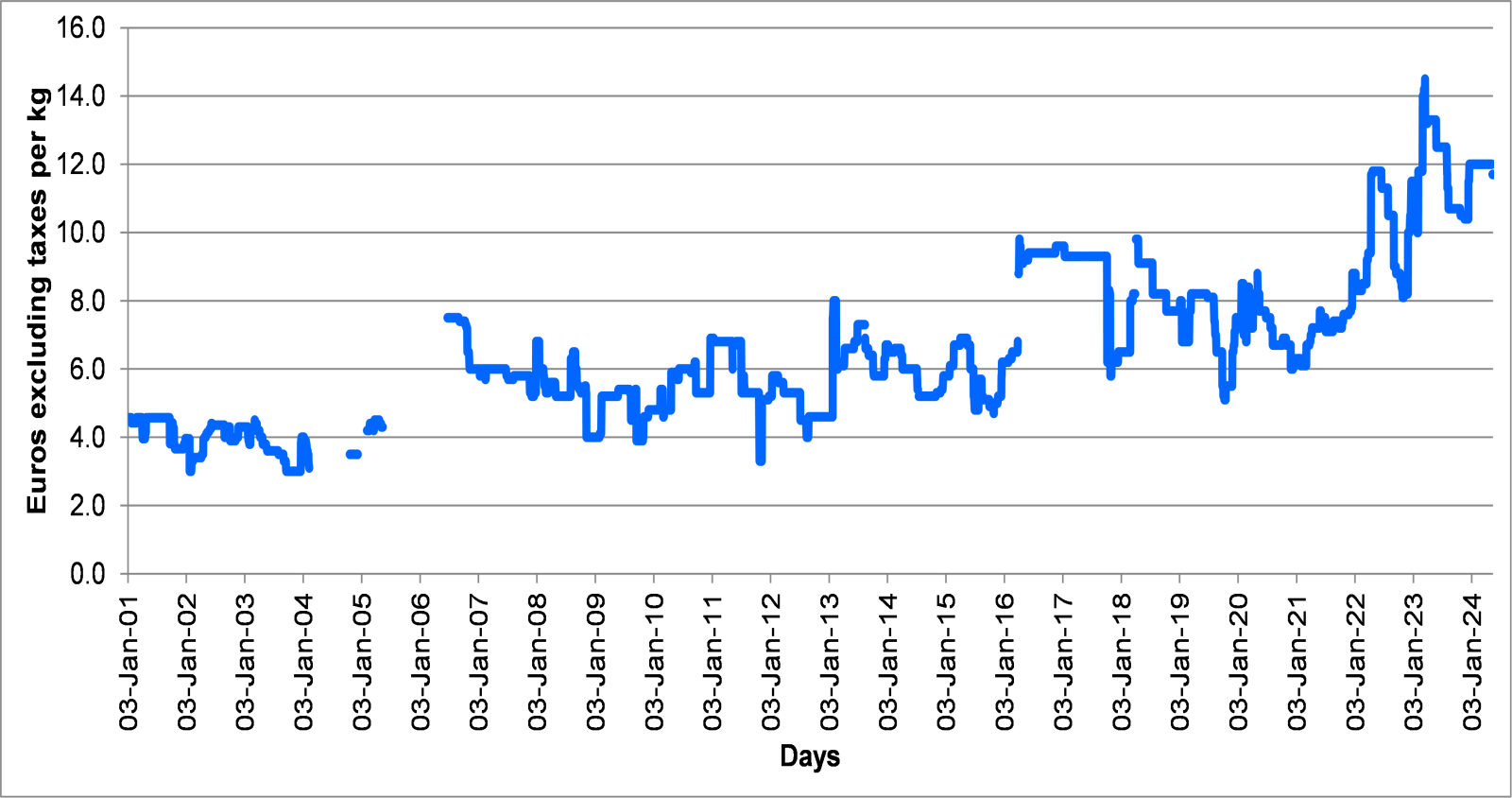

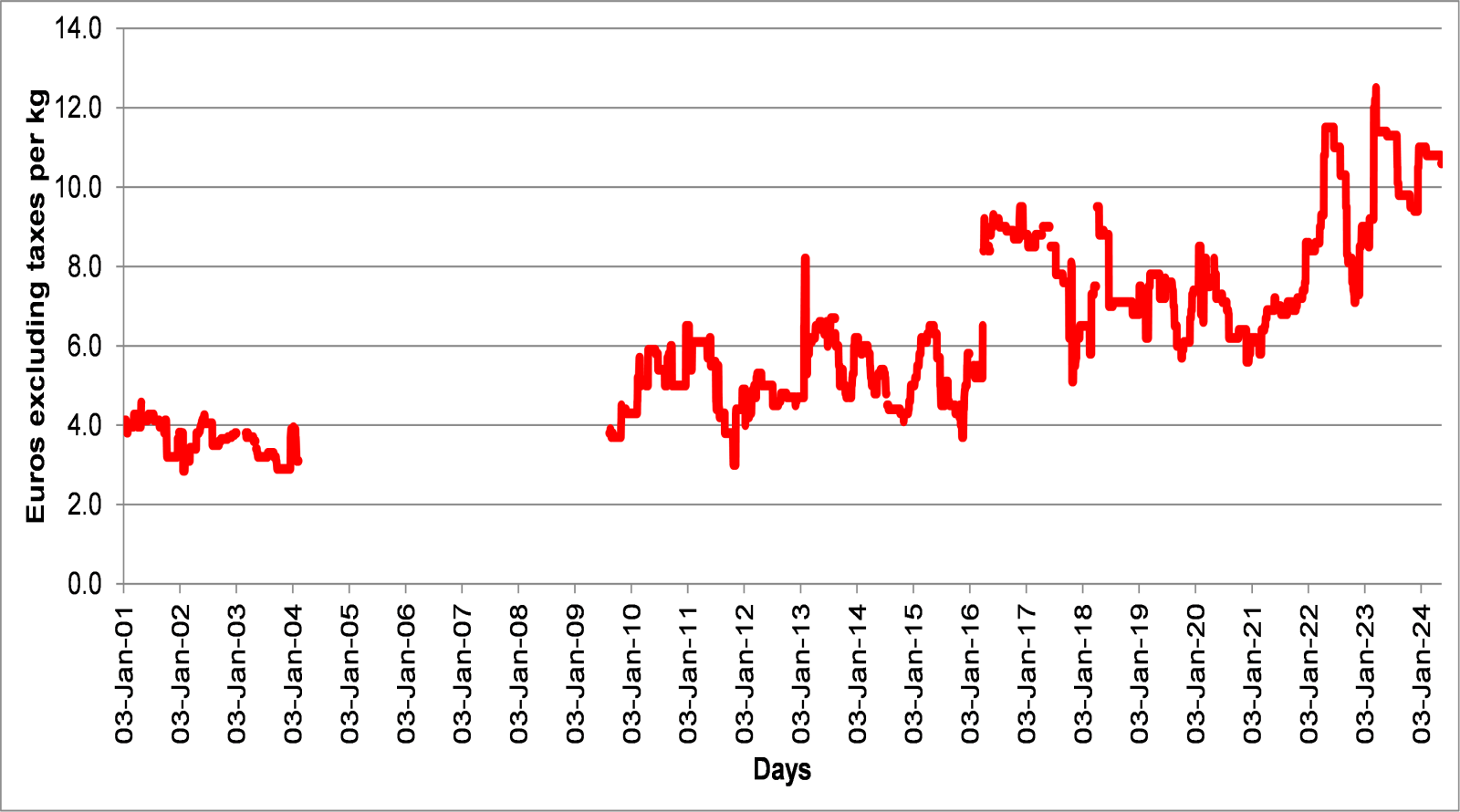

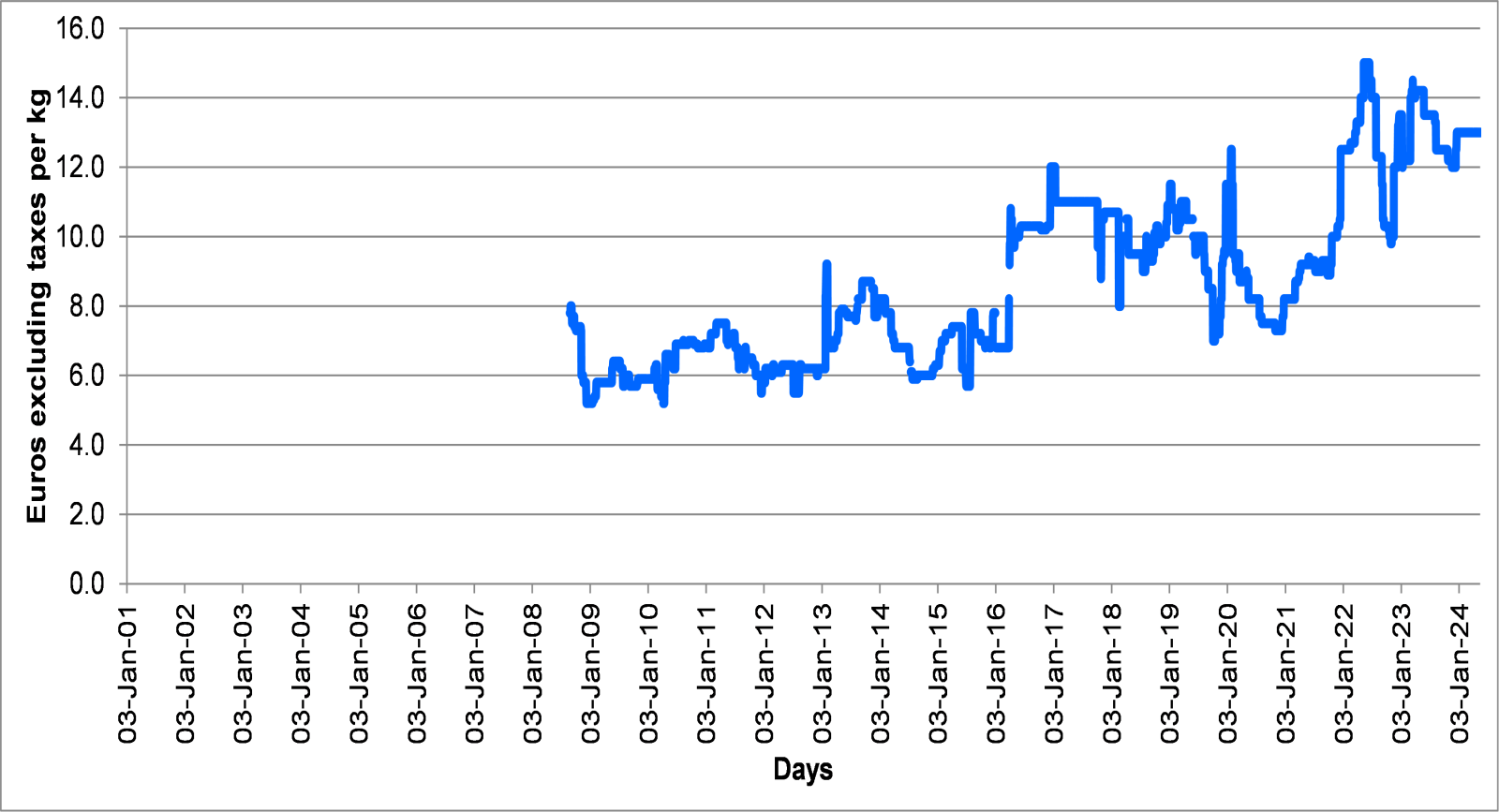

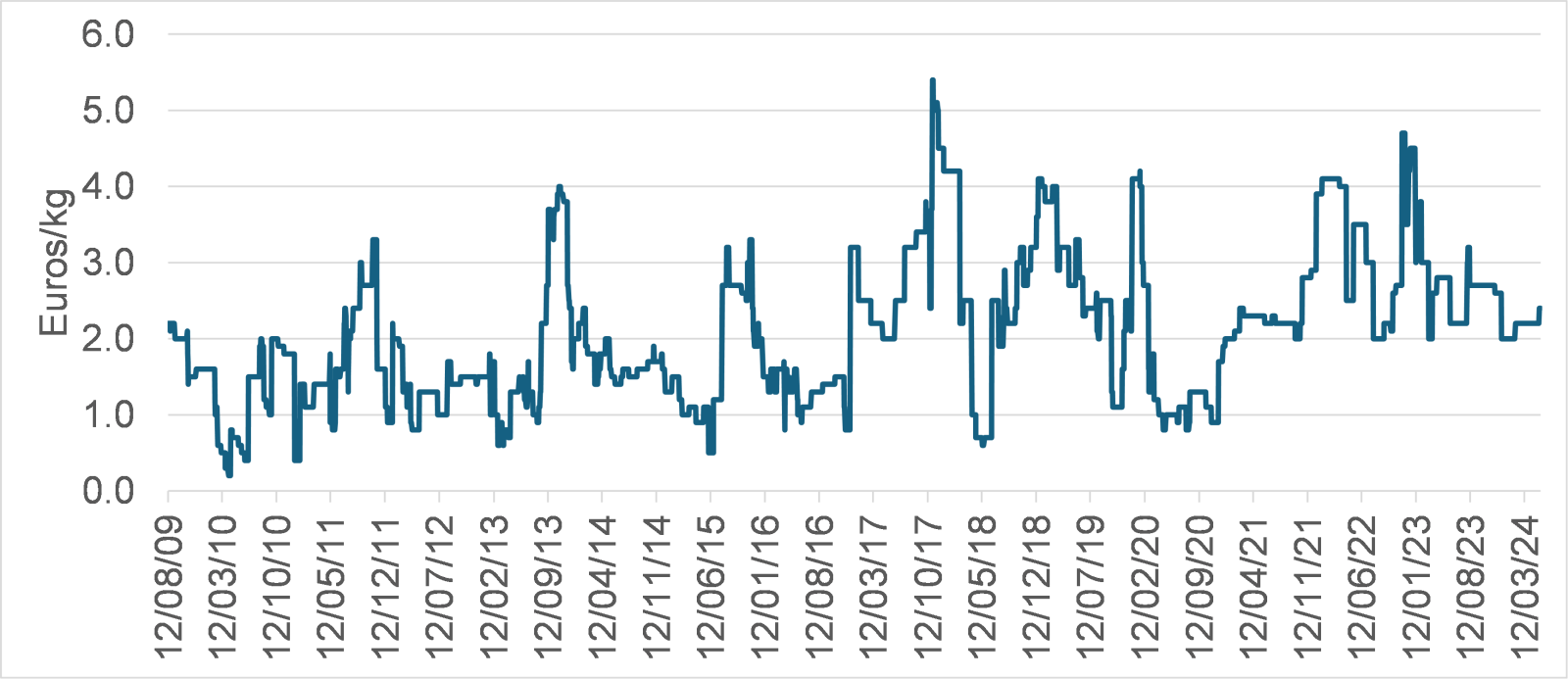

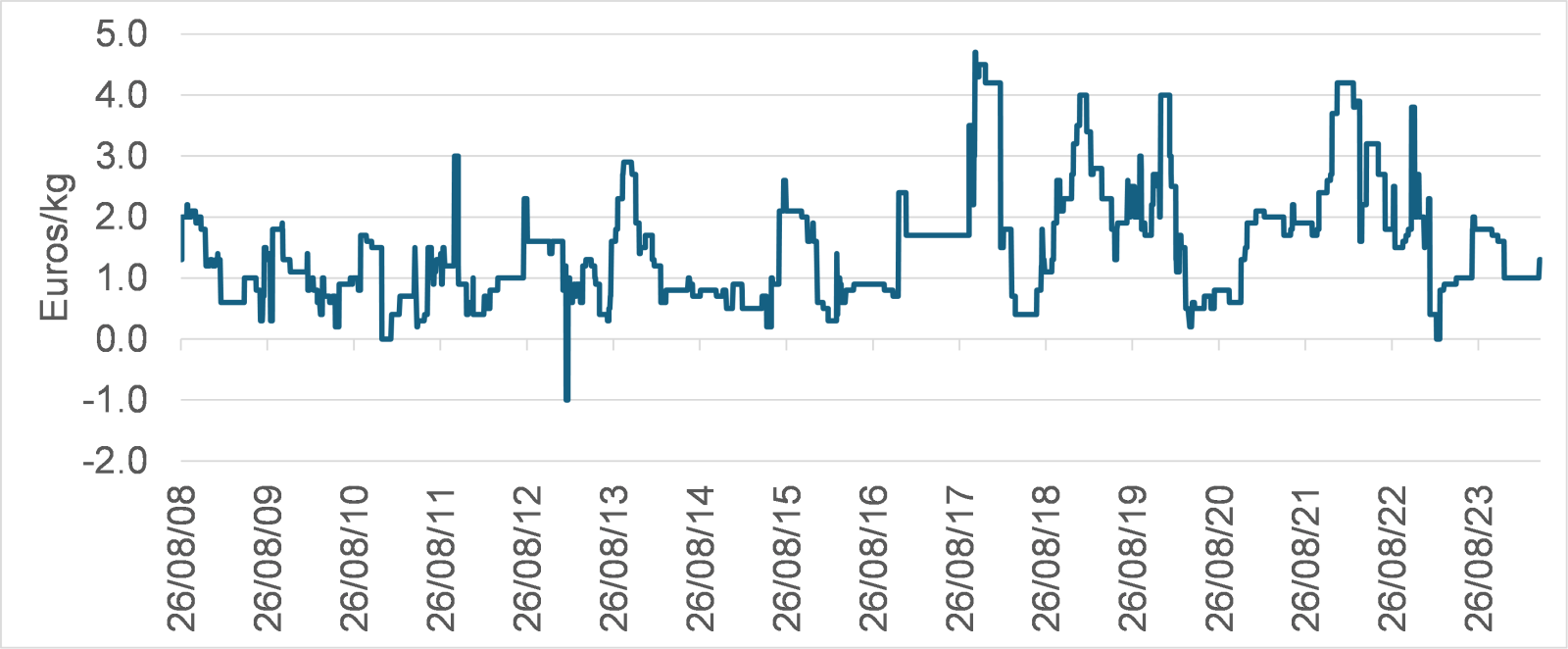

It should be noted that in the absence of accurate quantity data (i.e., they wasn’t any available), the analysis was carried out using only prices. The main explanatory variables used were year and a dichotomous variable representing the Brexit period, which takes the value of 1 after February 2020, 0 otherwise. Figures 1 to 3 show the evolution of the salmon prices.

Figure 1: Wholesale daily price of entire fresh farmed salmon of Scottish origin (not under the Label Rouge) 2-3 kg (Source: Market - MIN de Rungis)

Figure 2: Wholesale daily price of entire fresh farmed salmon of Norwegian origin 2-3 kg (Source: Market - MIN de Rungis)

Figure 3: Wholesale daily price of entire fresh farmed salmon of Scottish origin Label Rouge 2-3 kg (Source: Market - MIN de Rungis)

Model

We modelled 3 premiums (defining these, in the absence of cost of production data, as the difference between the prices of two products):

- Premium between Scottish prices and Norwegian prices (2-3 kg)

- Premium between Scottish prices (Label Rouge LR) and Norwegian prices (2-3 kg)

- Premium between Scottish prices (Label Rouge LR) and Scottish prices.

The statistical method used to represent the evolution of the three premiums considered as explanatory variables different lags of the premiums as well as year and the Brexit variable.

Results

The first result explored the relationship between the different prices. The evolution of the different salmon prices is very close, as the correlations between them were very close to 1.

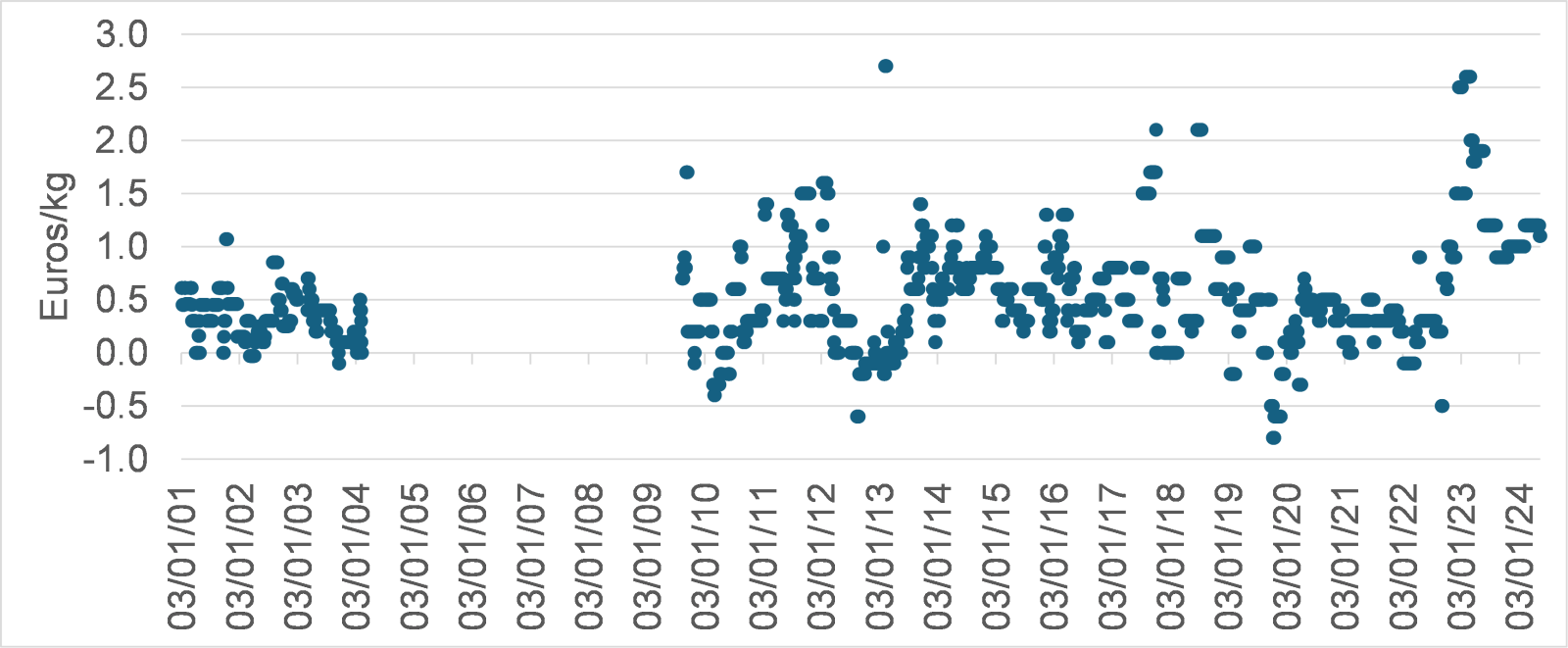

Moving to the regression results, we consider first the evolution of the premium between the Scottish salmon (excluding label rouge) and the Norwegian salmon for the same weight. Figure 4 presents the premium of Scottish salmon with respect to the Norwegian salmon (the mean premium over the period was 0.54 Euros/kg).

Figure 4: Premium – (Scotland – Norway) (Source: authors)

As shown in Figure 4, the premium is mostly around the mean but there are some cases where the premium was negative. In the absence of quantity data, it is not possible to figure out the reason for the reversion of the premium. The value of the Brexit coefficient was statistically 0 indicating that Brexit did not have any effect on the premium.

Figure 5: Premium - (Scotland LR – Norway) (Source: authors)

Figure 5 shows the evolution of the premium between Scotland’s label rouge and the Norwegian origin. The premium seems to have some seasonality and some slight positive trend (small but positive statistically significant coefficient of year). The value of the coefficient of the Brexit variable was not found statistically significant (i.e., no effect).

The next analysis is the premium of salmon under Label Rouge over the Scottish origin (i.e., non-Label Rouge). Figure 6 shows a variable positive premium although with the exception on one case where the premium was negative. As in the previous cases the value of the coefficient of the Brexit variables was statistically equal to 0 (no effect).

Figure 6: Premium – (Scotland LR – Scotland) (Source: authors)

The analyses confirm that Scottish salmon commands a price premium over Norwegian salmon and that this premium is very stable. The best prediction of the next day premium is the current premium. Moreover, salmon sold under the French Label Rouge indication commands a price premium with respect to the Scottish origin (i.e., without the Label Rouge) and the Norwegian origin.

It is important to note that if the costs of production of salmon under Label Rouge are higher than the “normal” Scottish salmon (i.e., sold without the label), the premium is only nominal (i.e., Scottish producers are not making profits by selling under Label Rouge). Unfortunately, in the absence of cost of production data, this was not possible to be tested.

The regression results indicate that there is slight increasing trend indicating that the Label Rouge premium might be increasing over time, but with changes (possibly due seasonality).

A limitation to understand the variability of the premiums is that the analysis was carried out using only prices. Without quantity data it is difficult to have a deeper analysis. This is because with quantity data it would be possible to model explicitly the supply and demand for the different salmon origins and identify whether the observed variability is due to supply issues (e.g., Brexit factors affect it) or demand. Note that data from United Nations COMTRADE or HMRC are too broad to be used to understand the prices of Scottish salmon in the French wholesale market.

Benefits

The research has increased our understanding of the recent trends of Scottish salmon prices and how Brexit could have affected this. Despite that simplicity of the analysis, it highlights the importance of high-quality labels and the need for producer to attain them. These labels connect primary producers directly with consumers and ensure that producers have a stable demand not easily substituted by products from other origins. This certainly informs policy and industry decisions on the way to move forward.

Finally, it is important to highlight the carried-out analysis does not rule out that Brexit related changes in the general terms of trade (non-tariff barriers) may have increased production costs to an extent e.g., to possibly reduced volumes of Salmon exports.

Project Partners

SRUC, Rowett

Lead image: salmon by David B Townsend (unsplash.com)