The eco-labels "Farmed Responsibly ASC Certified" and "Certified Carbon Neutral" can potentially enhance the desirability of Scottish salmon among UK consumers. Additionally, labelling Scottish salmon as “High in Omega-3” could further increase its value. However, it is important to note that while eco-labels and nutritional claims play a role, they are secondary factors influencing UK consumers' preferences for salmon. The primary drivers are price, freshness, taste, and the origin of the salmon.

In this study we aimed to explore whether UK consumers are willing to pay a premium for Scottish salmon and assess whether eco-labels and nutritional claims can enhance its appeal to UK consumers. A survey-based choice experiment was conducted to collect the data. In total, 2518 UK consumers of salmon completed the survey. The sample is representative of the UK population. The results showed that UK consumers prefer Scottish salmon over Norwegian and Canadian salmon.

Stage

Work CompletedDirectory of Expertise

Purpose

Scotland is the third largest producer of Atlantic salmon, behind Norway and Chile. Scottish farmed salmon is the UK's top food export, contributing £578 million in export value. The salmon industry plays a vital role in enhancing the country’s food security and economy by providing a nutritious source of animal protein, boosting trade, creating employment opportunities, and promoting infrastructure investment. However, the environmental impacts of salmon farming, such as eutrophication and sea lice infestations, can be extensive and significant. Eutrophication in marine ecosystems is a consequence of nutrient over-enrichment, mostly inputs of nitrogen, phosphorus and organic matter from land-based sources. (e.g., agriculture, urbanisation). Eutrophication leads to increased plant or algae growth, changes in the balance of organisms and water quality degradation.

In its Vision for Sustainable Aquaculture, the Scottish Government committed to enhancing the productivity of Scotland's salmon sector while mitigating the environmental impacts of salmon farming. Encouragingly, the Scottish salmon industry has also pledged to achieve net-zero emissions by 2045.

Reducing the environmental impact of salmon farming in Scotland could lead to higher production costs. If these additional costs are passed on to consumers, assessing whether Uk consumers are willing to pay a premium for more sustainably produced salmon becomes essential.

Therefore, the objectives of this study are as follows:

- Assess whether UK consumers value the use of eco-labels on Scottish salmon.

- Examine if UK consumers are willing to pay a premium for Scottish salmon over salmon imported from Norway or Canada

- Assess UK consumers' preferences and willingness to pay for alternatives to wild salmon, with a focus on farmed salmon and lab-grown salmon.

- Examine whether salmon colour and the "High in Omega-3" label impact consumer purchasing decisions.

- Investigate the heterogeneity of consumers' preferences and willingness to pay (i.e., the existence of consumer segments with different sets of preferences).

Results

A survey-based choice experiment was conducted to gather data, with 2,518 UK salmon consumers participating. The sample is representative of the UK population in terms of gender, age, employment status, and population distribution across the four UK nations. The survey included a choice task and a questionnaire.

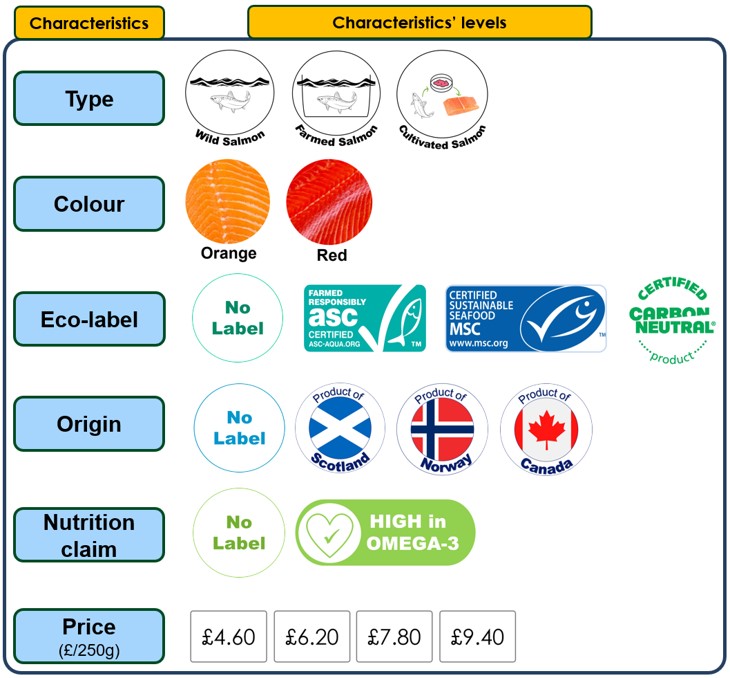

Six attributes were used in the choice task to describe the alternatives for salmon products: Type of salmon, Eco-label, origin, colour, nutritional claim, and price. Each attribute was defined in terms of at least two levels (see Figure 1).

Figure 1. Salmon’s attributes and attribute levels used in the study.

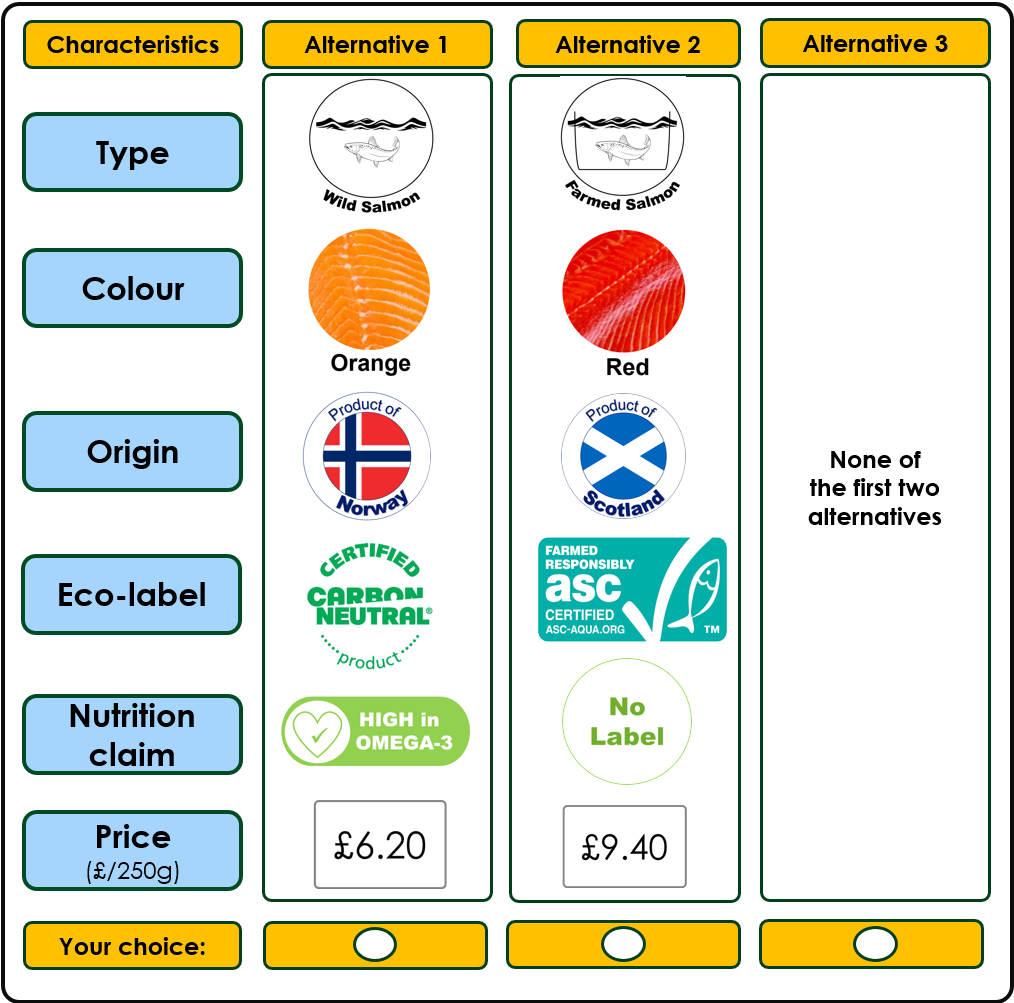

In the choice task, participants were successively presented with twelve choice sets. Each set included two salmon options along with an opt-out option. Figure 2 illustrates one of the choice sets used in this study.

Figure 2. Example of a choice set used in the choice experiment.

A questionnaire followed the choice task. The questionnaire collected information on respondents' sociodemographic characteristics, purchasing habits and attitudes toward several salmon attributes.

The data were analysed using a mixed logit model, the most suitable choice model for estimating individual preferences and willingness to pay based on choice data.

The analysis yielded many interesting findings and the key results are outlined here:

Average consumers’ preferences and willingness to pay

The average consumer willingness to pay for the different labels considered in the study is displayed in Figure 3.

Figure 3. Average consumers’ willingness to pay for the labels considered in the study

- The price of salmon was found to be the most determining factor in consumers’ choices of salmon (36% of respondents’ choice decision is determined by the price), followed by the type of salmon (28%), the origin (15%), the nutritional claims (10%), the eco-labels (8%), and the colour (4%).

- UK Consumers are willing to pay premiums of £1.07 and £0.98 per 250g of salmon for the labels “Farmed Responsibly ASC Certified” and “Certified carbon neutral”, respectively. However, they are not willing to pay a premium for the label “Certified Sustainable Seafood MSC” (for wild salmon).

- UK consumers value Scottish salmon significantly higher than Norwegian (premium = £0.95/250g) and Canadian salmon (premium = £1.02/250g).

- Interestingly, we found that, on average, UK consumers prefer wild salmon over farmed salmon as long as the price difference between the two types of salmon (being higher for wild salmon) is equal to or lower than £1.78 per 250g of salmon. However, 35% of respondents reported being unaware that most salmon sold in UK markets is farmed and not wild.

- UK consumers were found to highly value the use of the nutritional claim “High in Omega 3” and were willing to pay a premium as high as £1.35 per 250g of salmon.

- The majority of UK consumers preferred orange salmon over red salmon, and they are willing to pay a premium of £0.50/250g for orange salmon.

Heterogeneity of consumers’ preferences and willingness to pay

The analysis of the choice data revealed the existence of considerable heterogeneity in consumers’ preferences and willingness to pay.

- Ecolabels: the "Farmed Responsibly ASC Certified" label was the most valued eco-label among 52% of respondents. In contrast, the "Certified Sustainable Seafood MSC" label (used for wild salmon) received the highest premium from 25% of respondents, while the label “Certified carbon neutral” was the top choice of only 16% of respondents. Only 7% of respondents were unwilling to pay a premium for the three eco-labels.

- Origin: Scottish salmon was the preferred choice for 77% of respondents, while the remaining 23% favoured Canadian salmon over Scottish and Norwegian salmon.

- Type of salmon: wild salmon was the most valued type of salmon for 68% of respondents, while 25% preferred farmed salmon over wild and lab-grown options. Only 7% of respondents expressed no preference among the three types of salmon.

- Colour: 52% of respondents preferred orange salmon, while 16% favoured red salmon. Thirty-two per cent of interviewed consumers indicated that salmon colour does not influence their purchase decision.

- Nutritional claim: all respondents expressed to be willing to pay a premium for products labelled with the nutritional claim "High in Omega-3.

Consumption and purchasing habits

- 48% of respondents reported consuming salmon at least once a week at home, while 92% eat salmon at least once a month.

- 83% of respondents indicated eating in restaurants at least once a month.

- 80% of respondents buy salmon mainly in supermarkets.

- 69% of respondents stated that they eat salmon on the same day or one day after purchasing it. Only 16% of respondents reported freezing the salmon after purchasing it fresh.

- 59% of respondents indicated that they typically prepare salmon by baking it, 32% prefer frying it, and 23% choose poaching it.

- The majority of respondents mentioned freshness, price, and taste as the most important factors they consider when buying salmon. Only 3% of respondents reported that environmental benefits were the main factor in their purchase of salmon.

Benefits

Scottish salmon is the most valued salmon among UK consumers. Labelling Scottish salmon as "Scottish" in the UK market can increase its value by £3.80 per kg compared to Norwegian salmon.

The study revealed that UK consumers are willing to pay a premium for more sustainable farmed salmon that bears the labels "Farmed Responsibly ASC Certified" and "Certified Carbon Neutral." However, our findings also indicate that salmon sustainability is not a primary driver of UK consumer purchasing decisions. Thus, while eco-labels can enhance the value of Scottish salmon, the use of eco-labels and the pricing of more sustainable salmon should take into consideration the fact that social (e.g., origin, animal welfare) and economic (e.g., price, discounts) sustainability-related factors influence more UK consumer choices than environmental sustainability-related factors.

Another way to enhance the value of Scottish salmon is through the use of nutritional claims, particularly the claim "High in Omega-3." This claim can increase the value of salmon by up to £5.40 per kg, with a minimum increase of £0.76 per kg.

We saw that UK consumers favour wild salmon over farmed salmon, even though 35% of the interviewed consumers revealed to be unaware that most of the salmon sold in the UK is farmed. The high retail premium and limited availability of wild salmon in the UK may explain the current high demand for and purchases of farmed salmon compared with wild salmon. The results also indicate a need to enhance UK consumers' awareness of the negative environmental impacts associated with capturing wild salmon, as well as the environmental, health, and social benefits of farmed salmon.

Although none of the respondents expressed a higher preference for lab-grown/cultivated salmon, 43% revealed to be indifferent between farmed salmon and lab-grown salmon. Despite the potential environmental benefits of lab-grown meat (if produced on a large scale), safety concerns remain the primary barrier to consumer acceptance.

To the best of our knowledge, this is the first study to assess the role that ecolabels, nutrition labels, and origin-related labels can play in increasing the desirability of Scottish salmon in the eyes of UK consumers. The high price premium that UK consumers are willing to pay for more sustainable and nutritious Scottish salmon could encourage producers and exporters of Scottish-farmed salmon to place greater focus on the domestic market.

The findings shed light on important aspects (e.g., the price premium that UK consumers are willing to pay and consumers’ value for desirable labels such as eco-labels) that we think producers and marketers of Scottish salmon should consider when designing marketing strategies price and position their products in the UK market.

Project Partners

SRUC

The Rowett Institute

Alfiyatul Laeli Mutafaah (University of Edinburgh)