Interviews with key informants in the higher value cheese sector in Scotland revealed that although there was a market for their products, there were multiple barriers to operating their businesses.

The research project “Costs and opportunities for Scottish products with higher value status” involved qualitative interviews with people working in and with small to medium sized higher-value cheese businesses in Scotland.

Cheese is one of the UK’s highest value (worth nearly £400 million in the first half of 2023) and growing food exports. Cheese production depends on the availability of milk and as such the two sectors are intertwined, with the dairy sector contributing £800 million to the Scottish economy in 2021.

A key theme emerging from these interviews was that, although there is a market for Scottish cheese, it was perceived to be difficult for any of the supply chain to make a profit: smaller cheese producers had high costs and difficulties in both making efficiencies or expanding, while milk suppliers had increasing costs and are at the mercy of the market. The key points emerging from the interviews were that cheese makers should recognise the higher value embodied in their products and that retailers and food service enterprises should offer a wider variety of styles of Scottish cheese.

Stage

Directory of Expertise

Purpose

This project reviewed the costs and opportunities for higher value Scottish cheese products, such as Orkney Scottish island cheddar, which has a protected geographical name. It had three objectives, on which our three case studies are based.

1. Examine producers’ views on issues affecting Scotland’s higher value cheese sector (the subject of this case study).

2. Analyse consumers’ willingness to pay for higher value Scottish cheese products.

3. Produce a trade-off analysis model for the cheese supply chain in Scotland.

We hope that these case studies will provide ideas and analysis that will be of use to Scottish cheese producers, processors and policymakers, thereby contributing to the resilience of Scotland’s rural economy.

Results

We reviewed 246 recent studies, reports and data published between 2005 and 2024 on the cheese and dairy sectors. Informed by that review, we interviewed producers, others in the supply chain, and sector consultants (eight interviews in total). We asked them about their perceptions of: assurance labels, such as Protected Geographical Indication and organic; the policy and trade environments; and sector networking.

Interviewees’ views were mixed. However, common issues arose:

- Perception of a lack of regional processing facilities.

- Constraints in milk supply due to several factors, including cows not being replaced, the long time it takes young cows to start producing milk, and perceived contract restrictions on dairy farmers preventing them selling elsewhere.

- Dearth of experienced employees with suitable skills and able to do heavy work, and a lack of training available in Scotland. Succession and sector continuation were also of concern.

- A perception that it is hard to raise prices to cover increased costs, coupled with concern about low margins in cheese making. Cash flow is poor and increases in production capacity require ‘lumpy’ large-scale investment which make expansion difficult.

- Need for stability in the policy environment. There are ongoing policy developments at all levels such as concerning hygiene, environment, milk contracts and trade, which exacerbate uncertainty.

- Lack of funding / grants to help with improvements and expansion (e.g. for ‘lumpy’ investment).

- There was no single view of protected food names and their value, and several other assurance schemes, some of which appear to overlap, are in use. Using such schemes add costs to businesses.

Solutions suggested by interviewees and in the literature include the following.

1. Regional processing

Additional follow-on processing for milk; small / medium scale processing at abattoirs; and improved logistics capacity for small producers

2. Milk supply

Recent changes to processing contracts may offer opportunities for farmers to diversify and cheese makers to source more milk

3. Workforce development

- Sourcing trainers with expertise in international cheeses (e.g. brie, mozzarella)

On-site training visits Greater networking and skill sharing

4. Profit margins

Development of cheeses to satisfy market trends (e.g. demand for soft cheeses)

5. Policy environment

- Long-term marketing vision, policies and funding

- Funding / grant schemes, especially for ‘lumpy’ investment

Improved guidance and training for local officials to improve consistency across council areas

6. Assurance schemes / protected food names

- Market planning and surveillance to identify the most beneficial scheme(s)

Benefits

The benefit of qualitative research is that it encourages participants to say what is important to them. It is intended to surface and examine current issues in the sector, not to be a representative survey of it. This research spoke with micro- to medium-sized cheese producers, as it was considered that its findings would be of most value to them, rather than to large producers, which will tend to have more resources at their disposal to focus on sector developments.

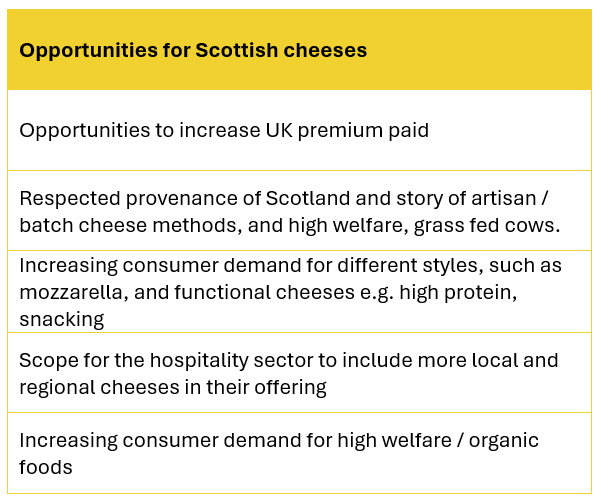

Our interviewees have many years and varied experiences of cheese making. However, common themes emerged from the interviews, summarised in the table below, that could help to frame policy debate and thinking about the future of Scotland’s high-value cheese sector. The future of higher value cheese is linked to the future of milk; and that to give provenance and story to add value cheese needs to be made from milk produced and processed in Scotland.

The final word goes to one of our interviewees:

“If we provide mediocre, boring cheese, why should people buy that? You know, they’ll buy either boring mediocre cheese from a supermarket which is even cheaper, or else they’ll buy good quality cheese from Spain or France or England. We have to improve what we do”.

Main image: Louis Hansel - Unsplash

Project Partners

This research was done by researchers at the Rowett Institute and SRUC. This research would not have been possible without the help provided by those in the sector who took part in our interviews and helped recruit interviewees. It was funded by the Scottish Government’s Environment, natural resources and agriculture - strategic research 2022-2027 programme, and is part of the project Costs and opportunities for Scottish products with higher value status. The project is overseen by a Steering Group containing policy and industry specialists.